Beyond Stocks and Bonds: A Retiree’s Guide to Diversifying Income

Why the portfolio that built your wealth may not be optimized to sustain it

Discover fractional property investing designed for retirees — fully managed and protected, with steady monthly income. So you can focus on living your best years.

Discover fractional property investing designed for retirees — fully managed and protected, with steady monthly income. So you can focus on living your best years.

Discover fractional property investing designed for retirees —fully managed and protected, with steady monthly income. So you can focus on living your best years.

Yes, at PropTXchange, we’ve made it possible.

After guiding thousands toward retirement through trusted paths like pensions, annuities, mutual funds and savings, we wanted to give you more. Now, you can enjoy the steady benefits of real estate — without tenants, paperwork, or stress.

We’ve made property investing accessible by removing the uncertainty, stress, and guesswork—so you can build wealth with confidence.

At PropTXchange, we make sure that every property is carefully verified and secured through escrow-backed transactions. That means you get transparency, safety, the confidence to start investing — and living the life you’ve dreamed of.

Retirement should mean freedom, not stress. We take care of the hard parts, so you can enjoy income and security.

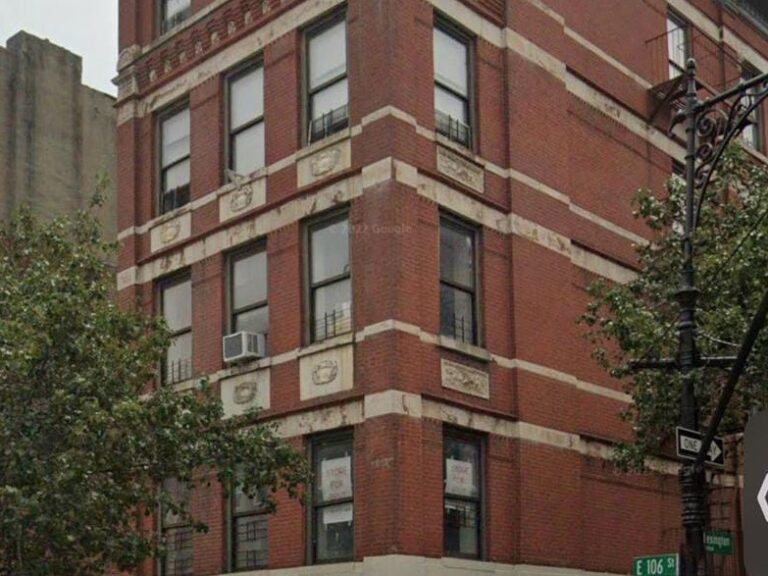

Choose from pre-vetted, income-generating properties with full transparency.

Make fractional investments using a secure escrow system.

Track returns, receive payouts, and resell when you’re ready — all from your dashboard.

Each listing is vetted, transparently priced, and professionally managed by PropTXchange.

Why the portfolio that built your wealth may not be optimized to sustain it

How a new investment model is reshaping real estate income in retirement

And how you can bridge the gap between retirement dreams and financial reality

Whether you’re new to real estate or rebalancing your portfolio, it’s normal to have questions. We’ve answered the ones we hear most often.

Many retirement investors allocate a portion of their portfolio to real assets like real estate to support income and diversification. Allocation varies based on individual goals, liquidity needs, and overall portfolio balance. Real estate is typically used to complement, not replace, stocks and bonds.

Real estate is less liquid by nature, which is why most retirees plan liquidity separately through cash, short-term instruments, and equities. A common approach is maintaining 12–18 months of expenses in liquid assets, while using real estate for long-term income, not short-term needs.

Many investors look at reducing bond exposure first, as real estate income can offer better inflation alignment. However, if a portfolio is heavily stock-weighted, trimming equities may also make sense. The right approach depends on overall balance and income objectives.

Investor funds are placed in independent escrow accounts and released only after predefined conditions are met. This structure aligns with standard real estate practices and helps ensure capital is deployed as intended.

Your gateway to transparent, secure, and accessible real estate investing

PropTXchange was created to make real estate investing simple, reliable, and within reach for everyone. With over 7,000 clients already trusting us as retirement planners, we bring a personal touch to property investment—grounded in experience, integrity, and transparency.

Unlike traditional property deals, every project on PropTXchange is fully verified, escrow-backed, and designed for investor confidence. Our platform allows you to start small, diversify easily, and build passive income at your own pace—without the complexities and risks of going it alone.

We believe investing isn’t just about numbers—it’s about your goals, your future, and the security of your family. That’s why we focus on relationships that last, and opportunities that are built to grow with you.

At PropTXchange, every decision is shaped by one guiding principle — safeguarding your financial journey. From verified properties and secure systems to decades of experience in retirement planning, we’ve designed a platform where transparency, trust, and your long-term success come first.

Verified Properties, Secure Systems

We take a regulatory-first approach, listing only U.S. properties that pass rigorous legal and financial due diligence. Your investments are always safeguarded through secure escrow accounts, giving you peace of mind from day one.

No Surprises, No Hidden Costs

We believe trust begins with clarity. That’s why our platform is free to explore, comes with no lock-ins, and has zero hidden charges. What you see is exactly what you get.

A Track Record That Speaks for Itself

With over 7,000 clients in retirement investment planning, our team has guided individuals toward building resilient, long-term portfolios. We bring the same financial discipline and insight to every property listed on PropTXchange. accounts, giving you peace of mind from day one.

Your Data, Protected Like Your Money

We safeguard your information with the same advanced systems trusted by banks. From secure logins to encrypted connections, your details stay private and protected every step of the way.