You’ve spent decades building your retirement portfolio the right way: consistent contributions, diversified holdings, disciplined rebalancing. Stocks for growth, bonds for stability, maybe some dividend-paying funds for income. It’s served you well.

But here’s something most retirees discover too late: the portfolio that builds wealth during your working years isn’t automatically the portfolio that generates reliable income during retirement.

Why Income Diversification Matters

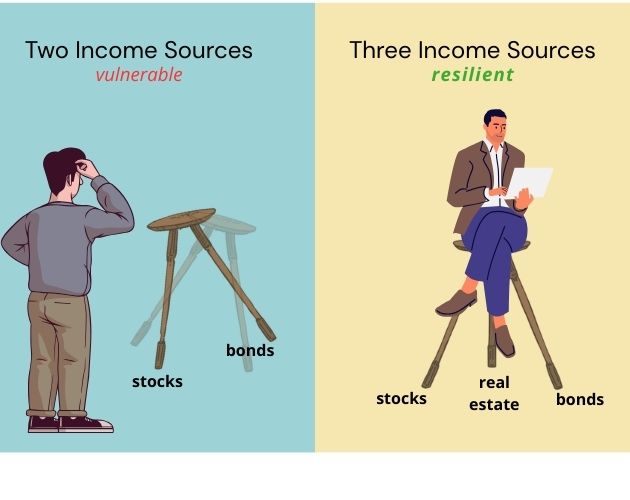

You already understand asset diversification—spread your money across different stocks, sectors, and asset classes. But here’s what most retirees miss: asset diversification doesn’t automatically give you income diversification. Your portfolio might be “diversified” across 50 different stocks and 20 different bonds. But if your income comes entirely from dividends and interest, you’re not diversified where it matters most.

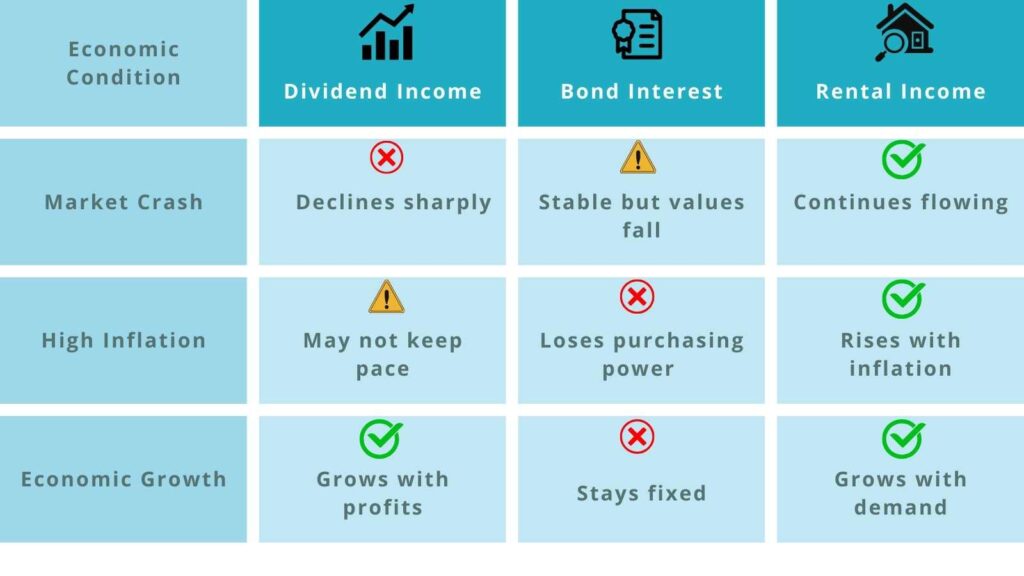

The problem: Dividends and interest both depend on the same thing—financial markets and corporate performance. When one weakens, the other typically weakens too. Look at what happens during different economic conditions:

Market crash: Companies slash dividends to preserve cash. Bond values fall. Both your income sources decline simultaneously. You’re forced to sell depreciated assets just to cover living expenses—locking in losses permanently.

High inflation: Dividend growth might keep pace, but often doesn’t. Bond interest stays fixed, losing purchasing power every month. Your income stays flat or falls while your expenses surge.

Economic contraction: Corporate earnings drop, dividends get cut. Credit tightens, yields compress. Both income streams weaken together.

This is what happened in 2008. Retirees watched their “diversified” portfolios collapse because their dividend income and bond income both depended on the same underlying economic conditions. They thought they were protected. They weren’t.

What you actually need is income tied to fundamentally different economic drivers—income that doesn’t care what the stock market did today, that rises when inflation rises instead of being destroyed by it, that flows from people paying rent rather than corporate earnings reports. That’s rental income: tied to people needing places to live and work, not Wall Street sentiment. During 2008, stock dividends collapsed. Apartment rents? They kept coming. During the 2021-2023 inflation surge, bond interest lost purchasing power monthly. Rental income? Rose right along with inflation.

How Much Should You Allocate to Real Estate?

The right allocation depends on your portfolio size and how much income you need real estate to generate:

$300K-$500K Portfolio

Allocation: 15-20% to real estate ($45K-$100K)

Income generation: $4,500-$15,000 annually (at 10-15% yields)

Strategy: One well-selected property provides meaningful income diversification. Your $50K-$100K investment generates income that doesn’t correlate with your stock and bond holdings, giving you real protection during market downturns.

$500K-$1M Portfolio

Allocation: 20-25% to real estate ($100K-$250K)

Income generation: $10,000-$37,500 annually (at 10-15% yields)

Strategy: Two to three properties allow geographic and property-type diversification. A $150K allocation generating $15,000-$22,500 annually creates a meaningful third leg of income that operates independently from financial markets.

$1M+ Portfolio

Allocation: 25-30% to real estate ($250K-$300K+)

Income generation: $25,000-$45,000+ annually (at 10-15% yields)

Strategy: Multiple properties across markets and types. A $300K allocation generating $30,000-$45,000 annually represents a substantial income stream that continues regardless of stock market performance—true portfolio resilience.

Key principle: Always maintain 12-18 months of expenses in liquid reserves before allocating to real estate. These are frameworks, not rigid rules—adjust based on your income needs and risk tolerance.

Putting It Into Practice: The Three-Source Strategy

Here’s how to move from theory to reality without disrupting what’s already working:

The Framework

Maintain stocks (40-50% of portfolio) for growth potential and liquidity. Your portfolio continues participating in long-term market growth, and you can access capital quickly when needed.

Maintain bonds (20-30% of portfolio) for stability and predictable payments. They serve as ballast during volatile periods and provide known income you can count on.

Add real estate (15-30% of portfolio) for inflation-protected income that moves independently. When stocks stumble, your property income continues. When inflation rises, your rental income rises with it.

Keep cash reserves (5-10% of portfolio) for true emergencies and opportunistic rebalancing.

The Transition

Step 1: Start with assessment Calculate how much of your current income comes from dividends and interest. If it’s 80%+, you’re vulnerable—both sources weaken together during market stress.

Step 2: Determine your target allocation Based on portfolio size (frameworks above), decide your real estate percentage.

Step 3: Move gradually, not dramatically

- Option A: Redirect new savings and dividends toward real estate over 6-12 months

- Option B: Rebalance 5-7% per quarter over 3-4 quarters

- Option C: Rebalance opportunistically when stocks hit new highs (sell strength, not weakness)

Don’t liquidate everything at once. Gradual movement reduces timing risk and gives you experience before full commitment.

Step 4: Diversify within real estate As your allocation grows beyond one property, spread across:

- Property types: residential, commercial, mixed-use

- Geographic markets: different metros, different regional economies

- Income profiles: some for steady current income, some with higher growth potential

Step 5: Rebalance with discipline Review quarterly. Adjust annually. As stocks rise or fall, your allocation drifts. Rebalancing back to targets means selling what’s up (stocks after gains) and buying what’s remained stable (adding to real estate)—the opposite of emotional investing.

What This Looks Like in Practice

Example: $750K portfolio, targeting 20% real estate

Starting position:

- 60% stocks ($450K)

- 30% bonds ($225K)

- 10% cash ($75K)

Target position:

- 45% stocks ($337.5K)

- 25% bonds ($187.5K)

- 20% real estate ($150K)

- 10% cash ($75K)

Transition over 9 months:

- Month 1-3: Redirect $50K from new savings + dividends → real estate (property 1)

- Month 4-6: Rebalance $50K from stocks (during market strength) → real estate

- Month 7-9: Rebalance $50K from bonds → real estate (property 2 or add to property 1)

Result: $150K in real estate generating $15,000-$22,500 annually—income that continues when your dividends get cut or when inflation erodes your bond interest.

The Real Diversification

The retirement portfolios that thrive over 20-30 years have one thing in common: income sources that don’t all weaken at the same time.

Stocks and bonds are essential. But adding real estate income—tied to fundamentally different economic drivers—creates true resilience. That’s not just diversification. That’s optimization.

At PropTXchange, we work with retirees who understand that protecting income is different from protecting assets. Our platform provides access to carefully vetted, income-generating properties designed to complement traditional portfolios.

Ready to build truly diversified retirement income?

[View Current Properties] | [Learn how to get started ]

Disclaimer: This article is for educational purposes only and does not constitute financial, legal, or investment advice. Please consult with a qualified financial advisor before making investment decisions.

About PropTXchange: PropTXchange is a real estate crowdfunding platform created by the team behind Alpha1 Partners, bringing decades of retirement planning experience to direct property investing.

Contact: info@proptxchange.com | New York, NY