For decades, there were only two practical ways to invest in real estate: you could buy property outright and become a landlord — dealing with tenants, maintenance calls, and management issues. Or you could invest through a REIT and hope for dividends, with little visibility into the underlying properties and no control over how decisions were made.

For many retirees, neither option felt right. Real estate income sounded appealing in theory, but the reality was either too hands-on or too indirect and opaque.

That gap has now been filled. Quietly, and without much attention, a new way of investing in real estate has emerged — one that offers direct access to income-generating properties, professional management, and transparency, without the responsibilities of ownership. It’s not buying a rental property. It’s not a REIT. It’s something fundamentally different — and particularly relevant for retirement investors.

What Real Estate Investing Used to Look Like

Historically, meaningful real estate investment required significant capital, time, and expertise. If you wanted exposure to apartment buildings or commercial properties, you needed:

- Large upfront capital for acquisition and reserves

- The ability to evaluate deals, negotiate terms, and manage legal complexity

- Either hands-on involvement or the cost of professional property managers

- Ongoing oversight of tenants, maintenance, and operations

- Local presence or trusted intermediaries

This model worked for developers, institutions, and wealthy families. For most individuals — especially retirees — it was impractical.

REITs later offered indirect access, but at a cost: limited transparency, no property-level control, exposure to stock-market volatility, and returns influenced as much by market sentiment as by real estate fundamentals.

There was no true middle ground. Real estate was either out of reach or out of your hands.

What Changed: A New Investment Model Became Possible

Over the past decade, improvements in digital investment platforms and regulatory frameworks have quietly reshaped how real estate investments can be structured and accessed. Today, real estate crowdfunding platforms make it possible to pool capital efficiently and offer investors access to specific, income-generating properties — without the complexity that once made such arrangements impractical. What previously required extensive paperwork, legal coordination, and long timelines can now be handled through structured, transparent platforms designed for serious investors.

For the first time, retirees can participate directly in individual real estate assets — reviewing property details, understanding income streams, and receiving distributions — while experienced professionals handle day-to-day operations. The barriers that kept real estate ownership limited to a small group for generations are no longer absolute.

Why This Matters Specifically for Retirees

This evolution in real estate investing aligns closely with what retirees need at this stage of life.

Reliable income

Fractional ownership in income-producing properties provides distributions tied directly to rental performance — not corporate dividend policies or market cycles.

Transparency and clarity

Instead of owning shares in a broad portfolio you can’t see, you invest in specific properties and understand exactly where returns come from.

Inflation alignment

Rents and property values tend to rise over time, helping income keep pace with rising living costs rather than losing purchasing power.

No operational burden

Properties are professionally managed. There are no tenant calls, maintenance decisions, or management responsibilities.

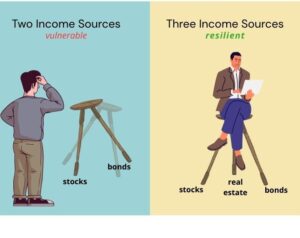

Diversification beyond stocks and bonds

Real estate income is driven by demand for housing and commercial space, not Wall Street sentiment.

This combination — accessibility, transparency, income focus, and professional management — simply didn’t exist for individual retirement investors in previous generations.

What This Means for Your Retirement Strategy

This isn’t about abandoning traditional investments. It’s about strengthening your overall approach. Allocating a portion of retirement capital to direct real estate participation can:

- Generate stronger passive income

- Reduce reliance on low-yield instruments

- Improve diversification

- Offer more favourable tax characteristics

- Provide the confidence of owning tangible, income-producing assets

For example, allocating $200,000 across carefully selected real estate opportunities could potentially generate $20,000–$30,000 in annual income (based on typical industry ranges), while also offering inflation alignment and asset-backed security.

Investments typically begin at higher minimums than mass-market platforms because quality real estate requires meaningful capital — and because serious investors benefit from cleaner structures and fewer participants per deal.

Your Next Step

If direct, income-generating real estate belongs in your retirement strategy, the next step is to evaluate real opportunities — not theories.

PropTXchange gives you access to verified, physically existing properties, structured for professional management and designed for serious retirement investors. The platform is built by the team behind Alpha1 Partners, with experience serving over 7,000 clients through retirement planning.

Review the properties.

Understand how the income is generated.

Take the first step towards strengthening your portfolio.

👉 View current properties

👉 Get started now

Invest smarter. Retire stronger.