You’ve worked hard, saved diligently, and counted on Social Security and your 401(k) to carry you through retirement. On paper, it should all add up. But for millions of Americans, it doesn’t.

According to national surveys, the median retirement savings for people entering retirement is around $200,000—far below recommended levels[¹]. At the same time, Social Security replaces only ~40% of pre-retirement income[²], even though most retirees need 70–80% to maintain their lifestyle. That shortfall creates the retirement income gap—and it’s bigger than most people realize.

A moderate, comfortable retirement typically costs around $5,000 per month, which includes housing, healthcare, food, transportation, utilities, lifestyle/ leisure, and miscellaneous expenses. But the average retiree only receives:

- $1,900 from Social Security

- $1,667 from 401(k) withdrawals

- Total: $3,567/month

This leaves a $1,433 monthly gap — or more than $17,000 per year. But here’s the real challenge: this monthly gap isn’t static—it’s growing. We’re living longer, which means retirement savings that once needed to last 15 years now must stretch for 25 or even 30. Healthcare costs are rising faster than everything else, while inflation quietly erodes your purchasing power every year. The old 4% withdrawal rule? Many advisors now recommend 3% or even less to avoid running out of money. Meanwhile, Social Security cost-of-living adjustments rarely keep pace with actual expenses.

Why Traditional Solutions Fall Short

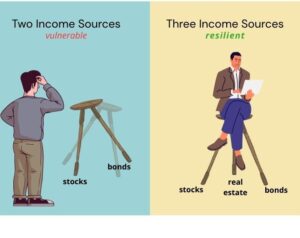

Common solutions—saving more, shifting to bonds, relying on market performance—aren’t enough anymore. Bonds barely keep pace with inflation, market volatility becomes dangerous when you’re withdrawing instead of contributing, and traditional pensions have largely disappeared. What retirees need now is income that’s reliable, somewhat inflation-resistant, and not entirely dependent on stock market performance. That’s where real estate enters the picture.

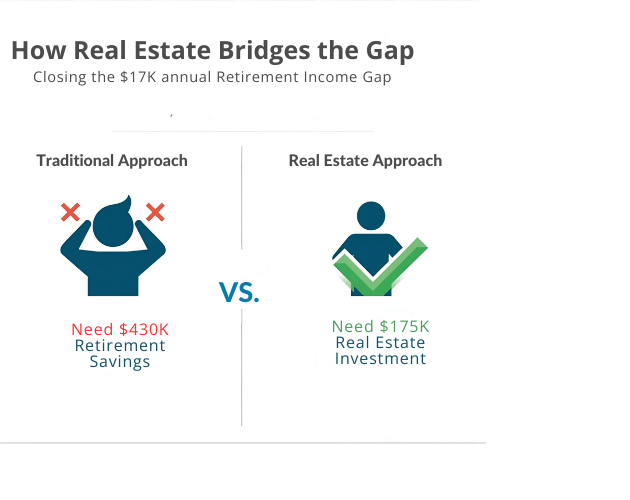

Here’s where the math shifts dramatically. To generate an extra $17,000/year through traditional savings, you’d need roughly $430,000 more in your retirement account. But with income-producing real estate, many investors achieve similar annual income with $150,000–$200,000 invested.

What’s more—Real estate provides something stocks and bonds can’t: predictable monthly income from rent-paying tenants, with values and rental rates that typically rise alongside inflation rather than being eroded by it. You get meaningful tax benefits through depreciation, and you’re investing in something tangible—actual buildings you can see and understand, not abstract financial instruments. It’s one of the few income sources that actually grows stronger over the course of a long retirement.

Your Best Strategy at Each Life Stage

No matter where you are in your retirement journey, a few smart moves today can reshape your financial confidence tomorrow.

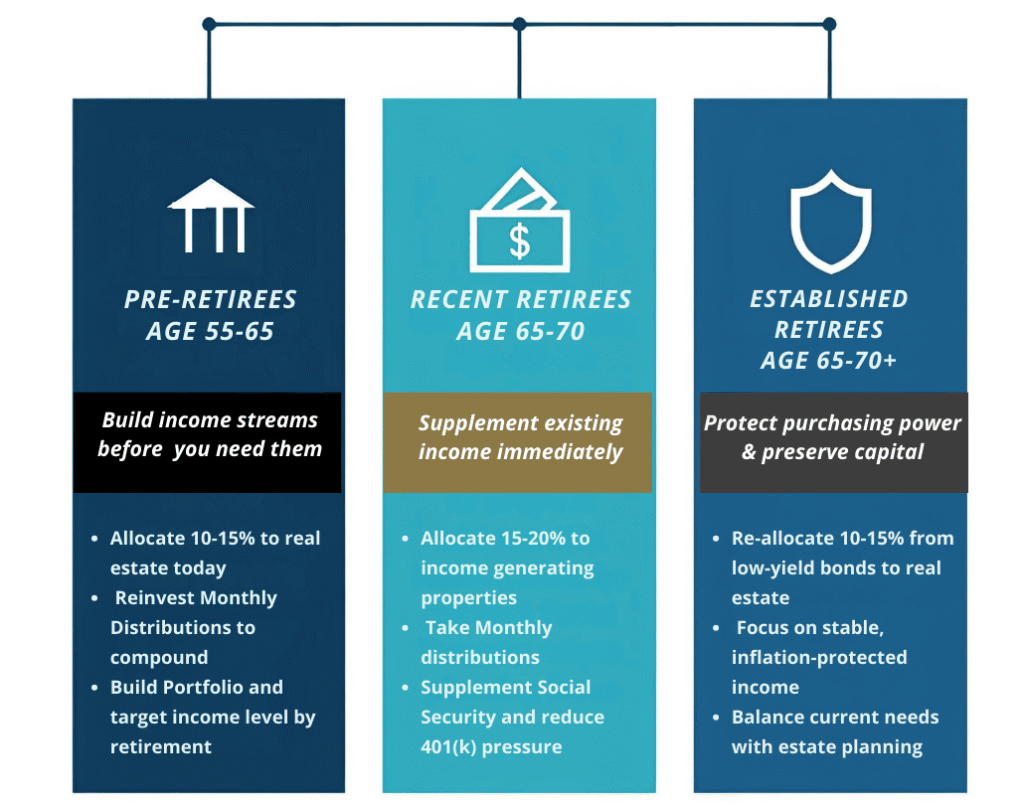

Pre-Retirees (Age 55–65): This is your moment. You still have time to build the income stream that will carry you through the next 25–30 years—but the window is narrowing. Your move:

- Allocate 10–15% to real estate income

- Reinvest distributions to compound faster

- Build a cushion before your pay check disappears. Use these final earning years to create your strongest financial foundation

A small shift now can mean a lifestyle you’re excited about—not one you’re forced into

Recent Retirees (Age 65–70): You’re in the transition zone. For you, income needs rise, stability matters more, and every unnecessary withdrawal chips away at your future. Your move:

- Allocate 15–20% to income-producing properties

- Take monthly distributions now

- Reduce pressure on your 401(k) and shield yourself from market swings that can permanently reduce your nest egg

Reliable income at this stage lowers stress, and gives you the freedom to actually enjoy retirement.

Established Retirees (Age 70+): Now it’s about security, dignity, and control. Your top priority is making sure your income keeps up with life—and your independence. Your move

- Shift 10–15% from low-yield bonds

- Focus on stable, inflation-resistant income

- Maintain your lifestyle without draining savings, and strengthen the legacy you want to leave

This isn’t just smart planning—it’s taking charge of the years that matter most.

Real Estate—Without the Landlord Headaches

Traditional property ownership comes with tenants, repairs, vacancies, legal issues, and constant management. Fractional real estate crowdfunding removes all of that. You invest in professionally managed, income-producing properties—and simply receive your portion of the monthly income. No maintenance. No stress. No 2 AM calls. It’s real estate income made accessible, diversified, and hassle-free.

Ready to Strengthen Your Retirement Income?

At PropTXchange, we help retirement-focused investors build reliable income streams through professionally managed, tokenized real estate—powered by decades of retirement planning experience through Alpha1 Partners.

[View Properties] | | [Learn How to get started]

Sources and References

[1] Federal Reserve. (2023). Survey of Consumer Finances: Median Retirement Savings by Age. Retrieved from https://www.federalreserve.gov/

[2] Social Security Administration. Replacement Rates for Hypothetical Retired Workers. Retrieved from https://www.ssa.gov/

[3] Bureau of Labor Statistics. (2024). Consumer Expenditure Survey: Retirement Spending Patterns. Retrieved from https://www.bls.gov/

[4] Fidelity Investments. (2024). Health Care Costs for Couples in Retirement. Retrieved from https://www.fidelity.com/

Disclaimer1

This article is for educational purposes only and does not constitute financial, legal, or investment advice. Please consult a qualified advisor before making investment decisions.